Hey. How are you? I’m dandy! Before I talk about strategic alliances let’s a take a moment of silence to reflect on some of the reasons why some Zimbabwean companies fail.

- Poor management

- Insufficient capital

- Location

- Lack of planning

- Over expansion (The Herald, 2012)

You can find some more reasons here in an article that I wrote, 3 Reasons Why Some Zimbabwean Companies Are Failing.

I will also add the crowd favourite right here:

- The state of the economy

OK. According to Forbes 90% of startups fail. According to The Herald hundreds of main stream companies have been liquidated over the past few years. I am sure if this issue was it be put to a vote most people would select the state of the economy as the major reason why businesses fail. I would select poor management. Anyway I think that some Zimbabwean companies need strategic alliances right now because they are failing and shutting down like computers. Strategic alliances will help to deal with a lot of the problems that I have listed above. Let us see why this is the case.

A strategic alliance is an agreement between two or more parties to pursue a set of agreed upon objectives needed while remaining independent organisations. This form of cooperation lies between mergers and acquisitions and organic growth. Strategic alliances occur when two or more organisations join together to pursue mutual benefits. Partners may provide the strategic alliance with resources such as products, distribution channels, manufacturing capability, project funding, capital equipment, knowledge, expertise, or intellectual property. The alliance is a cooperation or collaboration which aims for a synergy where each partner hopes that the benefits from the alliance will be greater than those from individual efforts. The alliance often involves technology transfer (access to knowledge and expertise), economic specialisation, shared expenses and shared risk. (Wikipedia)

In business it’s hard to soar with the eagles when you are surrounded by turkeys. Choose your strategic allies carefully.

Before we get to how strategic alliances would save Zimbabwean companies you have to know that as a business there are rules that you should follow when you choose your allies. Otherwise you will end up chilling with the turkeys. Here are some of the rules below:

- Focus on your core competencies, then fill the gaps with partners. In strategic alliances hire a strategic ally so that they can do something that you cannot do well. For example HP has an alliance with Canon in the ink jet printer market even though they have products that are related to that. Canon is better than HP when it comes to ink jet printers.

- Analyse and determine if there is a strategic fit between you and the potential ally. Of well known strategic alliances between Daimler and Chrysler collapsed because the two companies had different management styles. Daimler is bureaucratic and Chrysler is the opposite.

- Determine whether or not the positive (financial) impact that this alliance will have is worth the hassle. Some companies just want to grab everything that is in their path and they end up with a portfolio of diamonds and stones. Avoid this at all costs.

- In strategic alliances check to see if the potential partner has been in a partnership before, and how that worked out. It’s like a background check a guy does when he is interested in a lady.

- Check the financial health of your potential partner. You might partner with an entity which is about to go under if you are not careful.

There are many other checks that you have to perform but we will stop here.

Growing up I spent long periods of time walking alone. It was not because I was a bad person or that I was antisocial. It was because I and my ‘friends’ did not share much in common. I was in the wrong alliance.

You also cannot just expect to attract good allies without having something to offer yourself. You also should be able to accept that some alliances suit you and that some do not. You have to know the traits and qualities that define you and that these traits will make some parties want to associate with you and at the same time they will drive others away. I remember in university I had group of people that I liked to call my friends. There was something that I did not share in common with these guys, and that was alcohol. They drank, and I did not. Every time they would point this issue out to me urging me to drink but I did not take it up. It is no surprise that a lot of the times that they went out to have fun they left me behind. After university they stopped hanging out with me altogether. I understood, I just did not fit in. Let us see what qualities you have to possess so that you can attract good strategic allies that will stick around.

- You have to share the right information to prospective allies. From the get go your partners have to know all of the information that can affect them both negatively and positively. You do not want a situation where someone will get a nasty surprise and then end the union. Issues like the risk and benefit analysis have to be accurate and have to be shared before any commitment is made.

- Pay the utmost attention to detail. This is critical as you have to account for as many factors as possible. You have to look at how each partner had planned for the short term and the long term and how your alliance will affect those plans. Everything has to be accounted for down to the fates of the tea boys in both sides of the alliance. If a prospective ally notices that you do not leave any stone unturned it will make them confident that you have the ability to make the partnership succeed.

- Your corporate culture type has to be The Clan or The Adhocracy. This is because you have to be flexible in order for you to merge well and work around the cultural differences that your staff and the staff of your ally will have. The example of the failed merger between Daimler and Chrysler that I mentioned above would come into mind in this respect.

Partners in crime. The Nile Crocodile uses the Egyptian Plover as a toothpick. After a tasty meal the crocodile lies like a log with its mouth open waiting for the Egyptian Plover to show up and pick up the bits of food that are left stuck on its teeth. (Warren Photographic).

The following are the benefits that would accrue to some Zimbabwean companies if they became a part of strategic alliances. These benefits would, if utilised properly, would help to reduce the failure rate of Zimbabwean businesses offering them an escape route from doom.

1 Using Ancillary Services to Improve Your Offerings

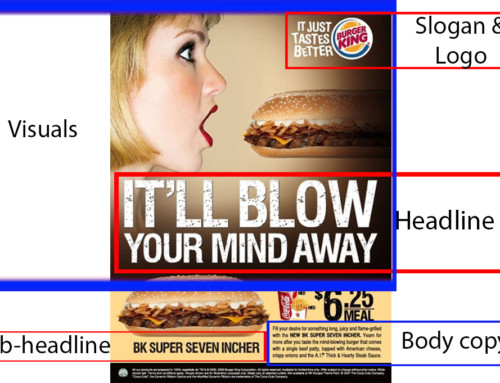

Over the years I have seen food outlets like Pizza Inn start certain services, then they stop them, then they start them again. An example of one of these services is Dial-A-Delivery. I do not think that it really caught on with people because it was expensive and you needed to make an order of a minimum size among other factors. Innscor made approximately $5 million dollars less in 2015 than they made in 2014 as shown in the image below:

As you can see Innscor’s revenue is going down. They could do with one or two tactics to make the situation better.

Given their current situation a strategic alliance (or alliances) might be in order. Dial-A-Delivery has the following advantages that could increase revenue for Innscor:

- It would save customers time making take aways easier to obtain as they do not have to go to the food court. This could increase sales

- Traffic at the outlets themselves could be reduced and this added convenience (a better environment and less waiting times) would increase sales from those who like to visit the outlets regardless of whether or not delivery is available

Now the problem of providing such a service is that Innscor would have to incur additional costs such as the following:

- Purchasing the vehicles

- Branding the vehicles

- Licensing for the vehicles

- Unscheduled repairs

- Scheduled maintenance

- Preventive maintenance

- Tyres

- Fuel

- Staff costs etc.

What if Innscor embarked on a logistical alliance with a taxi company or taxi companies? After ironing out all of the potential problems like the possible impact on Innscor’s image Dial-A-Delivery would be back and would probably be cheaper than if Innscor used its own fleet. You see where I am going with this? This could help to push up sales and help to buck the trend. In this case this Zimbabwean company needs a logistical alliance in order to push sales and stop a financial trend that looks like it might become a real problem in the future.

2 Entering New Markets

According to Webdev they are the market leader in Zimbabwe of ‘all things online’. I have always liked Webdev and they seem to be doing well. They have created a lot of websites like:

- seeff.co.zw

- kennanproperties.co.zw

- cbzbank.co.zw

Things look good on the surface but there is a theme that runs through their whole portfolio. My opinion is that in the long term these websites will probably not give the clients what they require from them in terms of results as they do not seem to be supported by a strategy that will make them very useful. What will happen now is that with time having a website will go down the list of priorities for many companies as they cannot see the return on investment. This will lead to less people knocking on Webdev’s door and so on.

I do not know if Webdev made this next move out of the realisation of what I have just said or it was a result of how they are evolving naturally as a technology company but Webdev has now gone into online payments through their company Softwarehouse (Private) Limited. They launched a website topup.co.zw which has the following promotional alliances, among others:

- ZETDC

- TelOne

- Africom

- Powertel

- uMax

Through this website the companies mentioned above sell their airtime and electricity vouchers. Through this one move Webdev suddenly has the customers of all of these companies as a target market and income generator. It has entered new markets in the form of energy and telecommunications. This Zimbabwean company needed this service alliance because if it continues to follow its business model as far as websites are concerned there might be tough times ahead for it, now they have a Plan B. Well done!

Here is another company that is showing signs that it needs a strategic alliance. Let us see why.

3 Increasing Brand Awareness

Allow me to quote source.co.zw. ‘Zimbabwe has four oil producing firms – ETG Parrogate, Surface Investments, Olivine and United Refineries whose combined production of 10,500 metric tonnes comes short of the country’s monthly requirement of 11,500 metric tonnes.

These four firms are failing to meet market demand for one reason or the other. The possible effects of failing to meet demand are:

- Foreign or local competition will come in to cover the gap. The article in The Source states that $41 million dollars’ worth of edible oils was imported in 2014. That is loss of revenue and who knows if a new competitor will not only come in to fill the gap but will also eat into your own market share as well?

- Failing to meet market demand also means that you might not fully utilising your equipment, staff, etc as they lie idle during production ‘down’ times. This will increase the cost per unit as the benefits of economies of scale are reduced. This will make the companies less competitive on the market as they will have to charge higher prices so as to make a good margin

- Less sales means less profits that can be used to reduce debt obligations. In the worst case this can lead to bankruptcy and the liquidation of the firm. To fight this a company might have to put in place stringent cost controls such as salary cuts and you know what will happen after that.

As you can see these four firms might need a strategic alliance so as to survive. They can form an alliance with Choppies and get shelf space in shops in Botswana and the other countries that Choppies operates in. The trade-off will be getting less shelf space in Zimbabwe and getting more shelf space in the more lucrative foreign markets like Dairibord seems to be doing. The quality of our local oils are good enough I am sure. The higher returns from the exports will hopefully lead to more capital being available to cover local demand. Phase 2 would be to use the brand awareness in the foreign markets gained from the association with Choppies and the extra capacity that will have been gained (from the higher profit margins) to sell their products to other supermarket chains in those foreign countries.

Strategic alliances may be key in saving a lot of our companies that are failing for various reasons. Strategic alliances not only offset some of the challenges that a company faces but they can also strengthen a company position in terms of things that it is good at. Do not forget that before you get into a strategic alliance there is a checklist that you have to tick ranging from the qualities that you should have yourself to what you should look for in a strategic partner. Do you think that Zimbabwean companies now need strategic alliances to survive? Will the strategic alliances be enough to save these firms? Let us know in the comments section below.

Thanks

Ruvimbo

Thanks Ruvimbo for this great article. It’s very insightful. I’m now convinced strategic alliances done with all due diligence can prevent most of our Zim companies from closing down.

You are welcome Russel thanks for taking the time to read the article. I am glad that you found it to be useful. There are many ways to kill a cat and this is one of them. I hope that some of the firms in the country take a leap of faith and go the route of strategic alliances. The less companies that go down, the better for all of us.

Thanks Ruvimbo.

‘….You have to share the right information to prospective allies…..’

Can I add that another important factor is to find willing strategic partners? I have tried strategic alliances over the years. I found that most companies or people I approached felt they could do it alone. They also felt I was more of a leech than a partner. It is disheartening to agree to do something or share some information with someone and they never deliver on their side of the bargain.

Like you I grew up walking alone. I ended up enjoying it. Even now most of the time I walk alone, especially when I am trying out a new idea. For example, going into a new market. Sharing the initially fuzzy data is difficult as I found I end up attracting a lot of naysayers. But whenever possible I try to have various forms of partnership when I feel the sum total is better than going it alone.

You are welcome Taurai thanks for reading.

That is very true. It takes two to tango because you cannot be in a relationship with yourself. What I think happens when someone seems to think that they can do it alone probably goes back to the reasons that the person will have gotten into business in the first place. One of the triggers of entrepreneurship are that a person feels stifled in terms of decision making in the workplace and decides it to ‘go it alone’. I think this mix of motivations comes in different doses in each case so maybe the people that you came across had ‘control over decision making’ high up on their list so they were not willing to partner with anyone and have less control over decision making. Usually what happens with these people is that with time they will get tired of making the decisions and will not derive as much satisfaction from that activity anymore. That will be the time that a partner can come in and a strategic alliance is formed. Keep on knocking on those doors they will open one day.

I can relate to what you are saying about fuzzy ideas. I have faced this problem ever since I started Plexis Strategy. For example I tried to get into the TEEP 1000 (Tony Elumelu Foundation) for new entrepreneurs and I failed to get a spot. I also tried to get into the YALI Program this year and I was not successful as well. I believe that to some extent my idea is still fuzzy because, for example, when I looked at those who made it for the TEEP 1000 from Zimbabwe the pattern that came out was that they were more into people who are doing ‘obvious’ things, e.g. manufacturing. It is hard for someone to validate my business idea so I understood.

It is a good thing that you constantly test yourself by entering competitions & other programs. You may not make it now but to borrow a term from your last reply to me, if you ‘keep knocking’ something is bound to give one day. That aside, there is always a bonus out of trying because you always take away some new knowledge or insight. For example you now understand, ‘…It is hard for someone to validate my business idea……’

I try everyday to learn about business and how I can succeed like the others I see above me. But the more I study the more I learn that things are not as clear cut as our business textbooks lead us to believe. There is an element of luck in why we end up succeeding in life. There are a lot of educated people who do not as much money as less educated people. Why? It is a product of when (timing), where (location) and who you know (connection/network). Let’s look at Zimbabwe today. I notice that we now have a generation of perennial students. We think that if we keep adding to our degrees we will one day land a plump job. Yet in the countries surrounding us people are making money with half the education we have. Even in our own Zimbabwe there are people who are bloated by making money via connections (family, politics etc) yet at school they were miles behind us in class. You may find this article by Dr. Chengwei Liu, as he explains how market leaders like Microsoft made it in the early days. http://www2.warwick.ac.uk/knowledge/socialscience/effectiveleadership

That is true you have to keep trying. Thanks for reminding me a lot of the times someone else has to remind you of some of these things. Yes when you get an insight you will derive real value from it by acting on it. That is probably one of the reasons why I am now working on validating my business idea by myself with the other two startups. As Douglas MacArthur said, ‘The best luck of all is the luck you make for yourself.’

I agree with you a million percent. I actually have been trying to reach out to the people around me (with no luck) telling them reading and reading and reading will not necessarily get you there. If at all it will give you a basic life and that is just about it. Luck definitely is a part of it, and to be honest I think that luck is on a spiritual level. Ask yourself, why were you born with the mind of an entrepreneur? What really influenced you to become one and make that choice? Yes we can say situations made us who we are but are others not in the same situation? We decided to make that move and just making a decision that others cannot or will not make is luck to me. As they say an opportunity is not a situation, it is a frame of mind and because opportunities happen in the mind some people perceive opportunities and others do not. The fact that I perceive opportunities were others do not sounds like luck to me. I feel for the perennial students, especially when they do not actually do research as to how much extra income they will get with their master’s degrees. A study showed that a person with a masters get’s roughly 10% more income than a person who does not have a masters, and that is not much considering the amount of effort that is put in. The fact that others are rich without that much education just proves that there are many ways to kill a cat. Personally I think that education is one of the longer routes that one can take. A safe, but long route. People need to understand that when you are trying to make money, a narrow range of skills and knowledge is required, there is no need to know everything.

WOW! A great read indeed! Thanks that is some angle there, I am already getting ideas. ‘More is Less’. Makes sense especially when they talk about the fact that performance and skill are two different things. The skill part actually answers the questions that you asked above. A person might not be good in class but it does not mean that they do not have a skill that can be used in business. As they say the day that you graduated you showed that you can cram a lot of information and regurgitate it in an exam setup, you did not show that you had the skills that are required in business. I guess those ‘failures’ from school had skills that they have since monetised on. Great article!

I’m glad you like the article.

I agree with you that luck is at the spiritual level. I have told my son about this spiritual level over the past years. Whether it makes sense to him is another matter. But what I have come to learn as I mature is that we tend to be slaves to scientific explanations most of he times. There are realms out there which are not explained by science. Only 1% of the world population have followed this voice. These are the 1% who we read about in Forbes. Just my thoughts.

‘But what I have come to learn as I mature is that we tend to be slaves to scientific explanations most of he times’. So true. I was lucky that growing up my father choose to talk to me about business on the way to school as opposed to talking about cartoons. One thing we argued about when I was in university was his insistence on the religious application of these scientific principles regardless of the situation. I told him that one day I would show him that science is not the only thing that matters. Maybe that is why my tagline is ‘Art and Science’. The ‘Art’ part of the tagline keeps the ‘Science’ aspect in touch with reality as the principles are adjusted in terms of their application depending on the situation.

That 1% is blessed because I am sure that even if they are asked as to why they are where they are today most of them might fail to explain why they do what they do, and why they think what they think.